Spring Clean Your Finances

As part of your annual spring cleaning, take some time to reassess your financial goals and long-term plans, and make sure that all of your related documents are up to date. Let’s review some of the most common questions to help you get through the process.

Balance Sheets

What are the benefits of keeping a personal balance sheet?

A balance sheet includes a current list of all your debts and assets, as well as things like account numbers, institutions and contacts. Understanding what you have is the first step to becoming financially secure and is your starting point for all future goals. It’s also a way to compare where you are now to where you were a year, five years or a decade ago, and it allows you to track the results of any changes you’ve made.

The first step, as part of your spring cleaning, should be to tie up any loose ends and make sure your records are safe, accessible and up to date. This includes updating your personal balance sheet.

Keeping an updated balance sheet provides ready access to current information and peace of mind when you need it.

Not only do balance sheets aid long-range planning, but they are a ready-to-use tool when it comes time to apply for a loan, make an investment or consider a purchase. A balance sheet can even offer protection.

Example:

One of our clients had a number of their financial documents stolen during a home break-in. Fortunately, they kept an updated personal balance sheet on a computer and on file with our Trust Services department, which enabled them to quickly contact their financial institutions and freeze their accounts to guard against theft. It provided invaluable information and peace of mind when they needed it.

What questions should I be asking myself?

Whether you’re still building wealth or have reached retirement, consider whether your short-, mid-, and long-term financial and life goals still align. Annual questions to ask yourself include:

- How is your spending plan going? Were you able to stick to your goals?

- Compare your estimated life horizon against your expected depletion of assets. Are you comfortable with the projected outcome

- Where is your career path headed?

- When do you plan to retire and what kind of lifestyle do you expect? How much have you saved?

- Is there a plan in place in the event of sudden death or disability?

- How has your financial advisor been performing?

- Has there been any legislative action that could affect your financial outlook?

A key part of financial planning also includes upcoming major expenses. Are you planning to travel? How old is your car and in what condition is your home? What kind of medical or dental expenses have you considered for you or a dependent?

Weigh the urgency and necessity of each demand and adjust your savings and investments accordingly so that your goals and reality are aligned.

An annual finance review is a good time for spouses/partners to check in with each other and make sure their objectives are mutually understood.

It’s important that couples discuss upcoming events and their goals to ensure that they’re still on the same page. Each partner should also know where records are stored, especially when one partner handles all the finances.

Example:

A client whose husband suddenly passed away didn’t know where to begin in handling his estate because he had managed all of their accounts for many years. Fortunately, a balance sheet was found on his computer that provided account numbers, passwords and more – enough to get her started.

Why should I have an estate plan?

An estate plan provides direction for handling your assets should you pass away or become disabled. Experts recommend annually evaluating any changes to your estate plan and your personal balance sheet. A few questions to consider:

- Did you buy or sell any assets?

- Did you change any bank/brokerage accounts to another institution, or receive new account numbers?

- Do your accounts have a payable on death (POD) designation and do any names need to be updated?

Every three or five years, it’s a good idea to take an even deeper look at your estate plan. Depending on your comfort level, you should reread all estate documents. Is it what you remembered? Are there changes that need to be made? Contact your attorney or CPA to ask if there have been any legislative actions (estate tax laws, how assets passing via POD beneficiary designation are treated, etc.) that could affect your plan.

Why should we review beneficiaries?

The human element is very important to consider in your estate plan. Changing financial and personal situations related to your beneficiaries may affect the decisions you make about your estate. Here’s some questions to consider:

- Have any beneficiaries experienced major changes in their life, such as marriages, divorces, new children or health issues?

- Have your beneficiaries experienced changes in their financial outlook?

- Are any beneficiaries receiving disability benefits that would end if they received a gift from you?

- Does anyone have issues with gambling or substances that could affect their ability to utilize an inheritance?

- Did anyone turn 18 or 21 or any other age that might change the nature of a gift from you?

Life changes related to you and your beneficiaries may prompt you to rethink decisions about the handling of your estate.

In addition, two federal acts in recent years (SECURE Act and SECURE Act 2.0) altered the rules for retirement savings and inherited plans that could affect beneficiaries. The required age and amounts of withdrawals have changed, as did some qualifying relationships. As a result, there could be new tax implications.

The ownership of life insurance policies, as well as how the beneficiaries are listed on life insurance, can affect how they are treated for estate tax purposes. Given Oregon’s fairly low threshold for estate tax, this is likely to be a consideration for most people with life insurance.

Purging Files

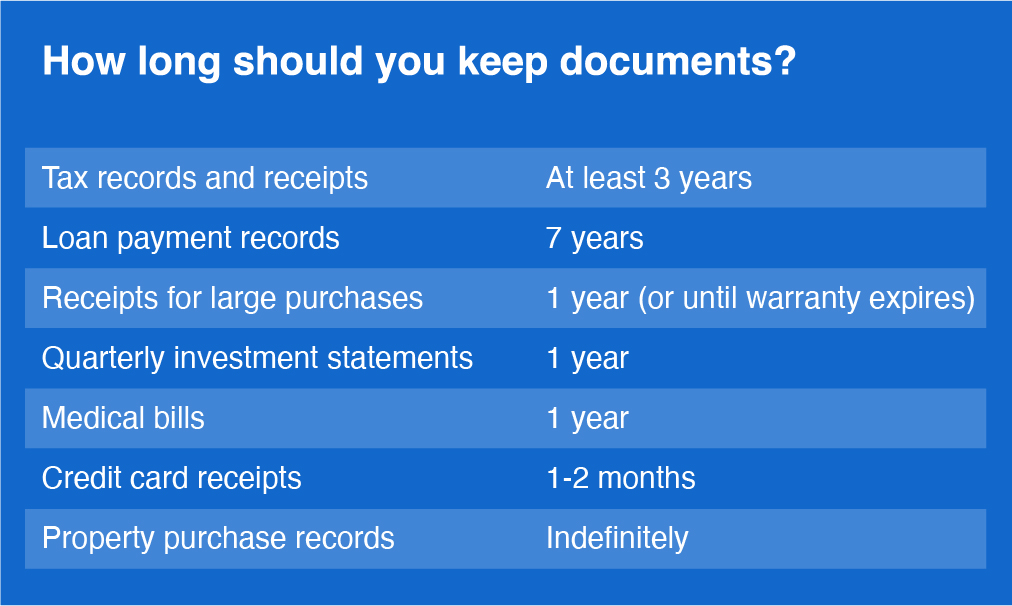

How long should I keep personal and financial records?

While there are some documents you’ll want to keep indefinitely (if not forever), most financial records can be purged after certain lengths of time.

Most month-to-month statements need only be kept until payments have cleared, but it’s a good idea to keep records of loan payments and large purchases longer. Also hold on to records of home and property purchases.

Tax records should be kept a minimum of three years, but seven years is recommended if you recorded capital gains or losses. Digital storage of your returns can help keep them organized but be sure to keep supporting documents.

Example:

It’s critical to keep up-to-date records of major life changes. A client’s family couldn’t remember the year or the last name of a person involved in a divorce with a family member. They had to spend $3,000 to research the case in order to meet legal requirements. A divorce decree on file would have saved a lot of time and expense.

Documents to keep in a safe place

It’s a good idea to keep originals of vital paper documents in a safe or a safe deposit box. Also, make sure to keep backup digital or print copies of your balance sheet and estate plan.

- Social Security card

- Birth certificates

- Death certificates

- Marriage certificate

- Divorce decrees

- Adoption papers

- Wills

Ready For Future Needs

If you haven’t already, put together a personal balance sheet and keep it updated as circumstances change. By re-evaluating your financial future and your estate plan on an annual basis as part of your spring cleaning, you and your family will have the best possible guidelines in place should the need arise. Contact us at Trust Services to get started.

If you found this article helpful, please spread the word! If you haven’t already, sign up for quarterly editions of Trust Matters, as well as our OPB e-news featuring business and nonprofit spotlights, scam alerts and financial tips. Be sure to check the boxes for your preferred region, as well as Trust Services. Thank you!